VUCA: We Can’t Plan, but We Can Prepare

We can diversify our markets, customers, markets and materials in order to prepare for the day when VUCA and its impacts arrive at our shops.

#pmpa

VUCA, or volatility, uncertainty, complexity and ambiguity, has grown to fill our business environment. Recently, we have seen volatility in terms of tariffs being removed from Canada and Mexico, only to be threatened again against Mexico, in order to persuade the Mexican government to take action on immigration policy. The United States has become a source of volatility as opposed to our historic role as a shelter from such macro market surprises.

As pricing continues to swing wildly, uncertainty of supply and sourcing continues for shops trying to meet customer demands for the world’s best materials. Customer and regulatory demands remain complex, with demands for disclosures on sourcing and regulatory compliance requiring hours of specialized talent just to decipher the requirements. (We’re looking at you California Prop 65.)

Featured Content

Ambiguity can be seen as all of the negative indicators for the economy (unexpectedly weak job reports, inverted yield curve, slowing of growth in the ISM PMI, and so on). These are refuted by our shops’ stellar sales performance. In April, thePMPABusiness Trends Sales index was its fifth highest value ever, and in May it came in at 140, sixth highest value ever. Will the Fed adjust interest rates? What about the trade war with China? What is going on in Iran? Clearly, we encounter some aspect of VUCA every day.

Each of these factors—volatility, uncertainty, complexity and ambiguity—can and do impact our business at any time, but because of their unexpected nature we cannot plan for them. They can erupt spontaneously with no apparent warning. We cannot plan for VUCA, but there are some steps we can take to prepare for the day when VUCA and its impacts arrive at our shops.

Diversify Your Markets

About twice a year, I meet with my broker and we rebalance my investment portfolio. As some of my holdings outperformed others, the allocation grew, changing the risk in my portfolio due to the outsized proportion that the outperformers have become. When did you last rebalance your market portfolio? Are you overweight in automotive? Fluid power? Are you underweight in appliances? What about medical? If that inverted yield-curve-predicted recession arrives, will you be too heavily involved in a market that feels that pain? What is a good balance of markets for your company and its capabilities? Is it time to rebalance?

Diversify Your Customers

Without customers, we would have no business. Customers bring us their needs, and filling those needs creates the economic opportunity for us to use our technology and talent to provide solutions and profit. However, as I learned early on in my career, there are customers, and there are customers. When was the last time you reviewed your portfolio of customers to make sure that you have the right ones for your business and risk profile? Which ones provide reliable volume and payments on time, which are always on extended terms of payment or increasing your costs by breaking in schedules because of terrible forecasts? Which customers are too high in demands for the volume and margins you get in return? When the market turns, those already on extended terms will be a further danger to your bottom line. What should your ideal customer portfolio look like? Now that you have full sales and staffing, isn’t this a great time to rebalance that as well?

Diversify Your Processes

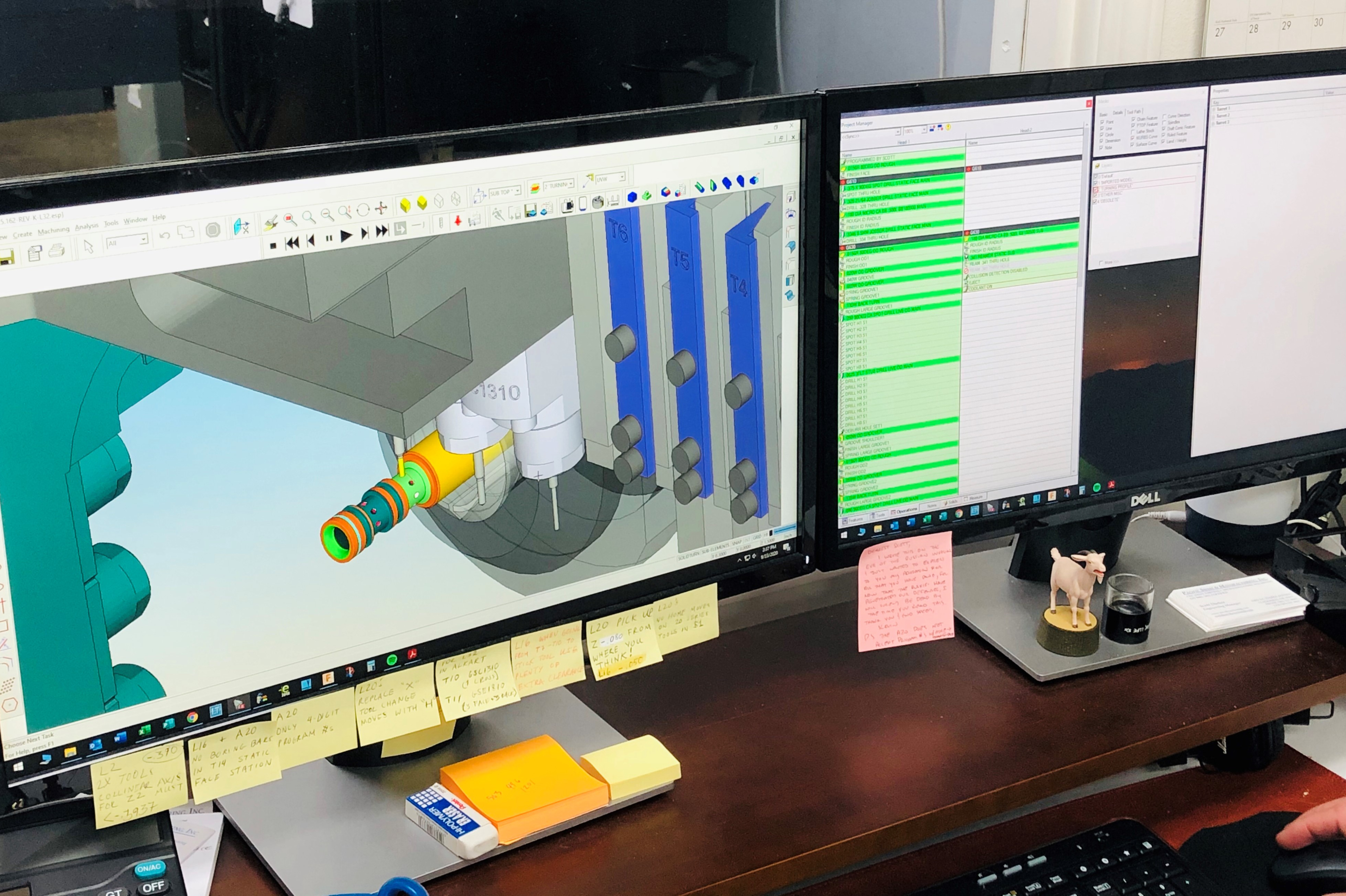

Just as we can get overweight in our portfolio of markets served or customers, it is possible that we can be overweight in processes which may have served us well for the past decade, but may not be up to the demands of our ever-changing market. And our technology tends to be driven by our markets and customers served, so when was the last time you and your team reviewed your technology portfolio to see any excess? What could you add to improve throughput, quality or new capability? Hand in hand with technology is the talent that is driving your processes and creating value for your customers. Cross training is another consideration, as loss of one or two key performers could create its own VUCA event for your shop operations.

Diversify Your Materials

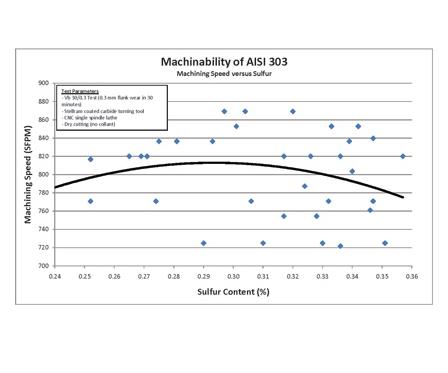

的一个主要VUCA过去一年的事件the imposition of “Section 232 Tariffs on Steel and Aluminum.” We are not suggesting that we substitute brass for steel or aluminum to avoid tariffs. However, we are asking if your shop is being limited by the choices of materials that you prefer to quote and machine? Today’s machine, workholding, tool and coating options make materials that used to be considered extremely difficult to machine now routine and manageable in our operations. Some materials that were considered impossible to machine are now, thanks to these developments in technology, merely difficult to fabricate.

Parts made from less free-machining materials generally sell for a higher price per part, often because fewer shops are quoting because of the material. Is your shop needlessly avoiding opportunity because of “old thinking” about materials? I saw tungsten carbide being machined at Horn in Tübingen, Germany. Nobody thinks of machining tungsten carbide, and yet, it is possible. What profitable jobs are going unquoted because your shop doesn’t machine that grade of material?

We are living in a VUCA world. We can prepare for the surprise impacts, or we can merely react. The news reports (and common sense) tell us that the market is bound to soften. While we can’t know exactly when, we can take steps now to diversify our markets, customers, processes and materials to minimize our downside when that day comes. We have had a nice multi-year run. It is probably a great time to take stock of what we have grown into and rebalance accordingly.

RELATED CONTENT

Rapid Methods for Determining the Weight of a Steel Bar (Imperial Units)

Counting bars in a bundle and multiplying by weight per bar allows a quick “reality check” on whether or not the tag weight is correct, or how much weight is left in the rack.

Recovery, Recrystallization and Grain Growth — Three Phases of Annealing

Below are some of the terms and effects applicable to annealing steel.

How Do We Fix American Manufacturing?

In America, many have lost sight of the fact that the object of the act of manufacturing is not merely the generation of maximum profit, but instead the creation of value.